Flexible Sales-Based Repayments

The Best Way To Obtain Working Capital

Gain full transparency and control. Automated splits ensure repayment is seamless, secure, and predictable — empowering you to fund with confidence.

Why Business Owners Choose

Credit Card Split Funding Platform

Fast & Easy Access to Funds

Merchants prioritize speed. Same-day or next-day funding is a huge conversion driver because many seek capital for urgent needs like payroll, inventory, or unexpected expenses.

Flex payments

Choose daily, weekly, or revenue-based repayment options that adjust with your credit card sales. Confident repayment without choking cash flow.

Credit Card Splits Credit Card Splits

Credit Card Splits

Transparent Pricing

No hidden fees or surprises. True costs are itemized for simplicity. We reduce friction and build trust when you need it most. Credit Card Splits Credit Card Splits

No Collateral Required

Qualify without pledging collateral. Approvals are based on revenue, not assets. Safe, unsecure financing. Personal assets aren't required to receive funds. Don’t risk personal or other business assets.

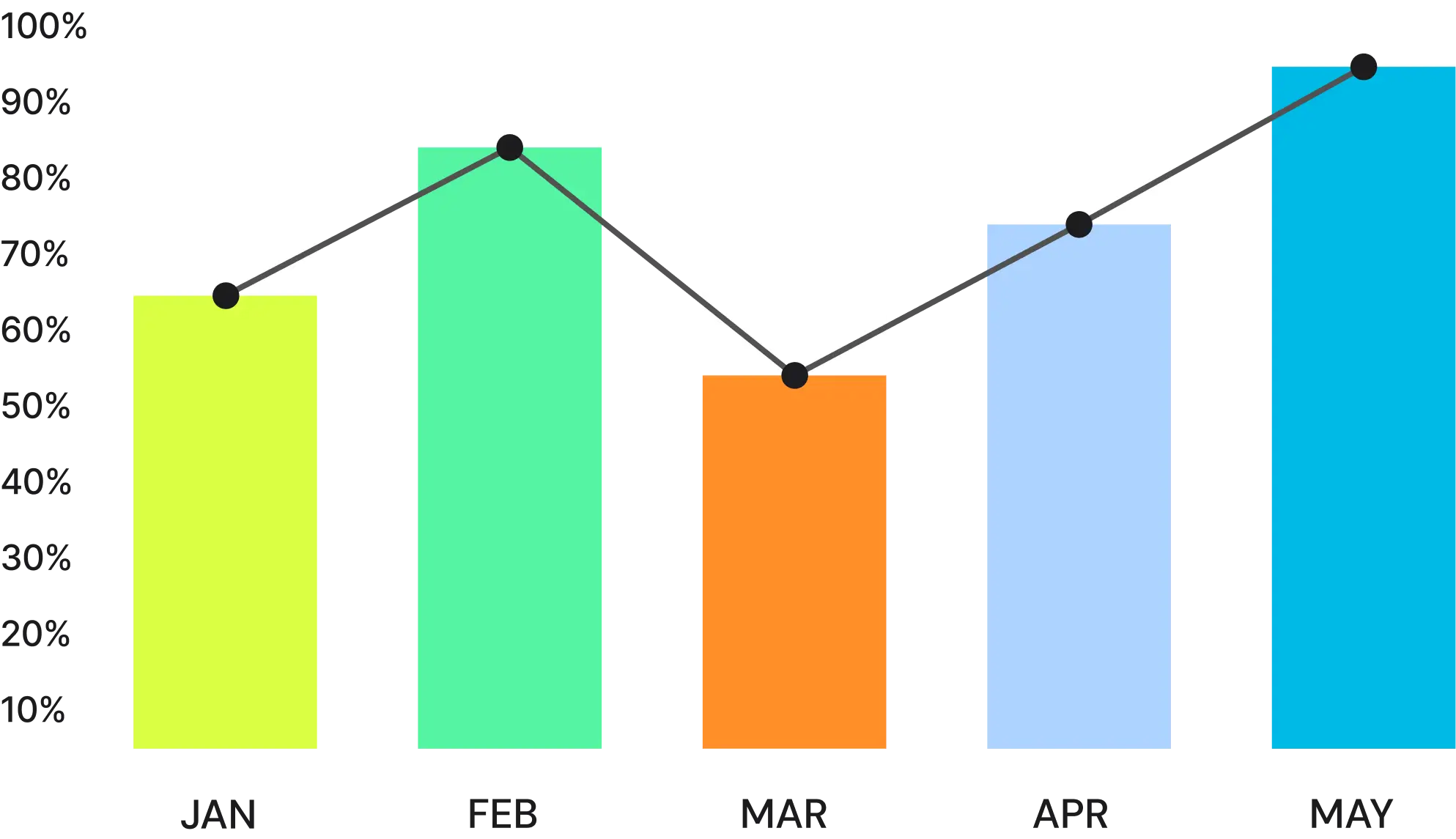

Highest Approval Rates

Credit Card Splits funding have much higher approval rates (80–90%) compared to SBA loans (25–35%) and bank loans (15–20%). Based on last 6 months credit card sales, not FICO score.

Repeat Funding & Top-Up Access

The ability to quickly access additional funds after partial repayment is a major retention and conversion benefit—merchants love knowing they can come back easily.

Flexible Use of Funds

Working capital with no restrictions (unlike traditional bank loans) allows merchants to apply funds to marketing, payroll, renovations, or inventory. That freedom increases appeal.

Simple Digital Application Process

Streamlined online applications, automated bank/API connections, and minimal paperwork directly reduce drop-off rates and increase conversions.

Personalized offers

Up to $5,000,000 in working capital available.

Credit Card Splits

Strong Customer Support & Relationship Building

Merchants value ongoing support, account managers, and fast responses. This personal touch drives word-of-mouth and repeat conversions.

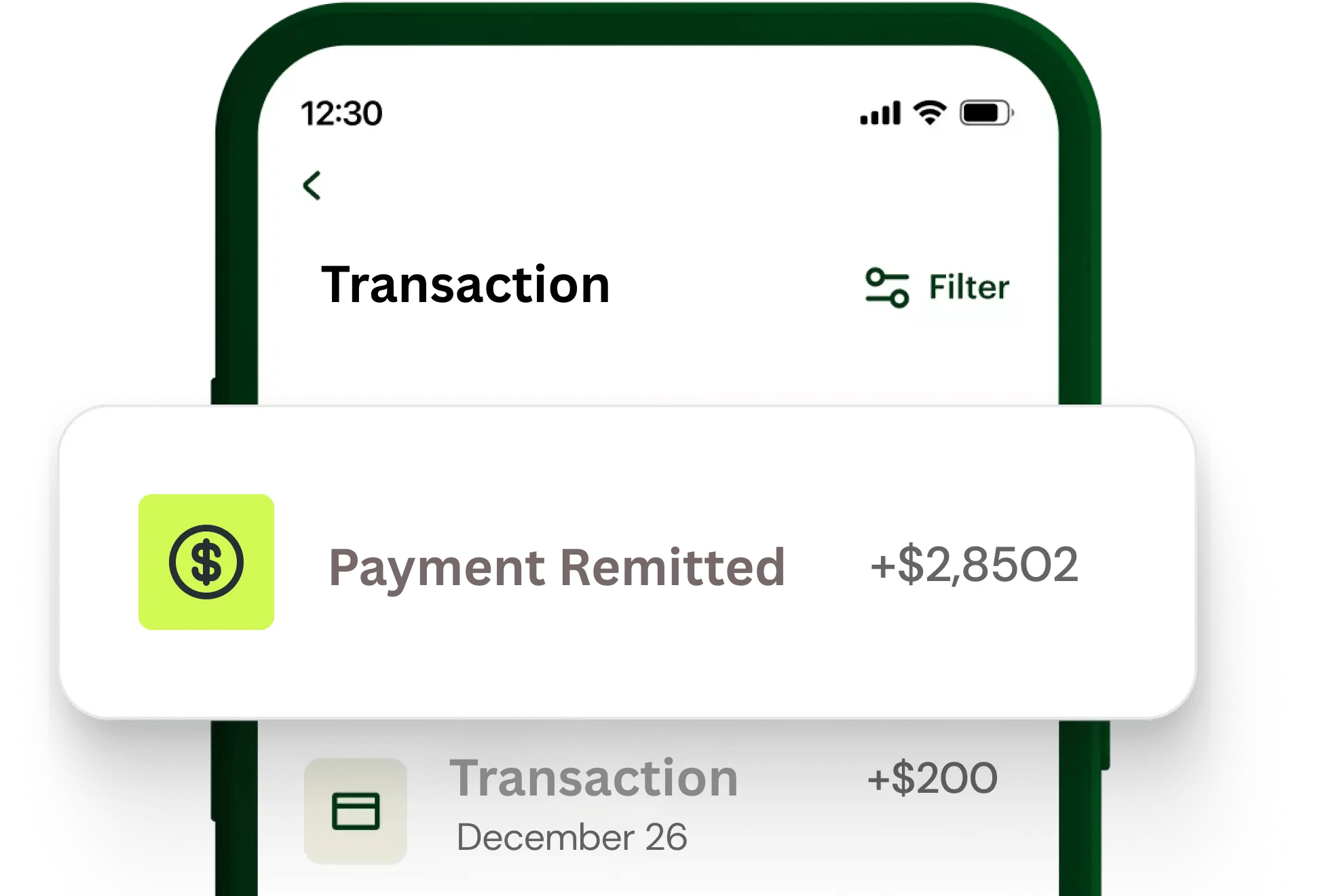

Secure Payments That Scale With Sales

Repayments flex with revenue; based on sales volume — less on slower months, and stable on strong months. Eliminates unwanted fees from ACH failures, reduces risk of default and helps stabilize cash flow.

Integrates with Square, Clover, First Data (Fiserv), Stripe, and Worldpay, with PCI DSS–aligned, bank-grade security.

Funding Agreements Managed

Repayments Processed

-

-

-

-

-

- 1K+

-

-

We Solve Your Funding Problem

We help eliminate delinquencies, overdraft fees, and manual collections which are costly and distracting making payback seamless, predictable, and secure.

Reduction in ACH failure risk when repayments are split at the point of sale (POS).

Transactions processed securely through our settlement rails.

Delivered to our clients for the working capital needs.

of Credit Card Splits applicants approved VS Only 34% of small business bank loan applications

How to Get Started in 3 Simple Steps

-

/01

Apply Online

Complete quick 5 minute application (Include last 6 months of bank) statements).

-

/02

Get Approved Fast

Funding approval based on sales volume, not credit. Access secure, seamless, and scalable capital.

-

/03

Receive Funding

Receive, review, and accept offer. Funds are wired immediately. Access capital without delays.

-

Apply Now

Ready to Launch?

Start funding today with automated repayments that flex with sales.

What clients say about us

Revenue-Based Business Cash Advances

A merchant cash advance (MCA) is a type of business financing where you get a lump sum in exchange for a percentage of future credit card sales. It’s not a loan — it’s a purchase of receivables.

Credit card splits refer to a repayment method where the MCA provider collects their agreed-upon percentage of a business’s daily credit card sales automatically, and the merchant receives the remainder.

Nope. We use a soft pull — it doesn’t impact your score.

A soft credit check lets lenders review your credit without affecting your score. It’s used for pre-approvals or eligibility checks.

You can repay early, but the cost is fixed — no discount for early payoff.

No. We primarily evaluate your monthly revenue and transaction volume, not your credit score.

Some of our clients have credit scores as low as 550. We provide funding based on your sales volume.

There’s no catch — but MCAs are more expensive than traditional loans. Always read the terms to understand the true cost of capital.

- Retail, food, salons, services — high card volume businesses

- Fast growth or seasonal businesses needing quick cash

- Owners denied traditional loans or with poor credit

- Startups under 6 months

- Cash-only businesses

- Businesses seeking low-cost long-term debt

Within 1-3 business days of approval. Same-day funding available on request.

Fast Funding

Getting funded has never been this easy!

Get a quote and see for yourself.